One: Filing an extension does not give you more time to pay your taxes.

Filing an extension means you are asking the IRS to give you more time to file your taxes. An extension of time to file your return does not give you any extension of time to pay your taxes. The IRS expects you to estimate and pay any owed taxes by April 18, 2023 to avoid possible penalties.

Extension requests are due by April 18, 2023. If you are worried about paying taxes you owe, see if you qualify for an installment payment plan.

Two: Your landlord is required to give you a Certificate of Rent Paid (CRP).

Minnesota Statues section 290A.19 requires landlords to provide a CRP to the renter. Your landlord must give you a completed CRP by January 31. If you cannot get a CRP from your landlord, you can request a Rent Paid Affidavit (RPA) to apply for the Renter's Property Tax Refund. The Minnesota Department of Revenue begins issuing Rent Paid Affidavits beginning March 1 each year.

Three: The IRS may have held your refund on purpose.

In 2015, Congress passed legislation for a refund delay that holds tax refunds claiming the Earned Income Tax Credit (EITC) and the Advance Child Tax Credit (ACTC) until February 15. This legislation aims to complete additional identity verification processes and help reduce errors in claiming these tax credits. This means that even if you file your taxes in January, you will get your refund after the third week of February. This delay applies to all tax preparation services.

Four: It’s not too late to get missed stimulus checks.

The stimulus checks are a federal tax credit, known as the Recovery Rebate Credit. If you didn’t get your first, second, or third stimulus check, don’t worry — you can still claim the payments as a tax credit and get the money as part of your tax refund. You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check.

You also may be able to claim missed stimulus checks through GetYourRefund.org.

Five:Tax year and tax season are not the same thing.

You’ll often hear the phrases tax year and tax season. These are not the same thing.

The tax year is the actual year where you earn income, pay income taxes, make charitable contributions, work side gigs, etc. The tax season is when you file, report and pay any taxes owed from the last year.

So, during the 2023 tax season, you file taxes for the 2022 tax year. Got it?

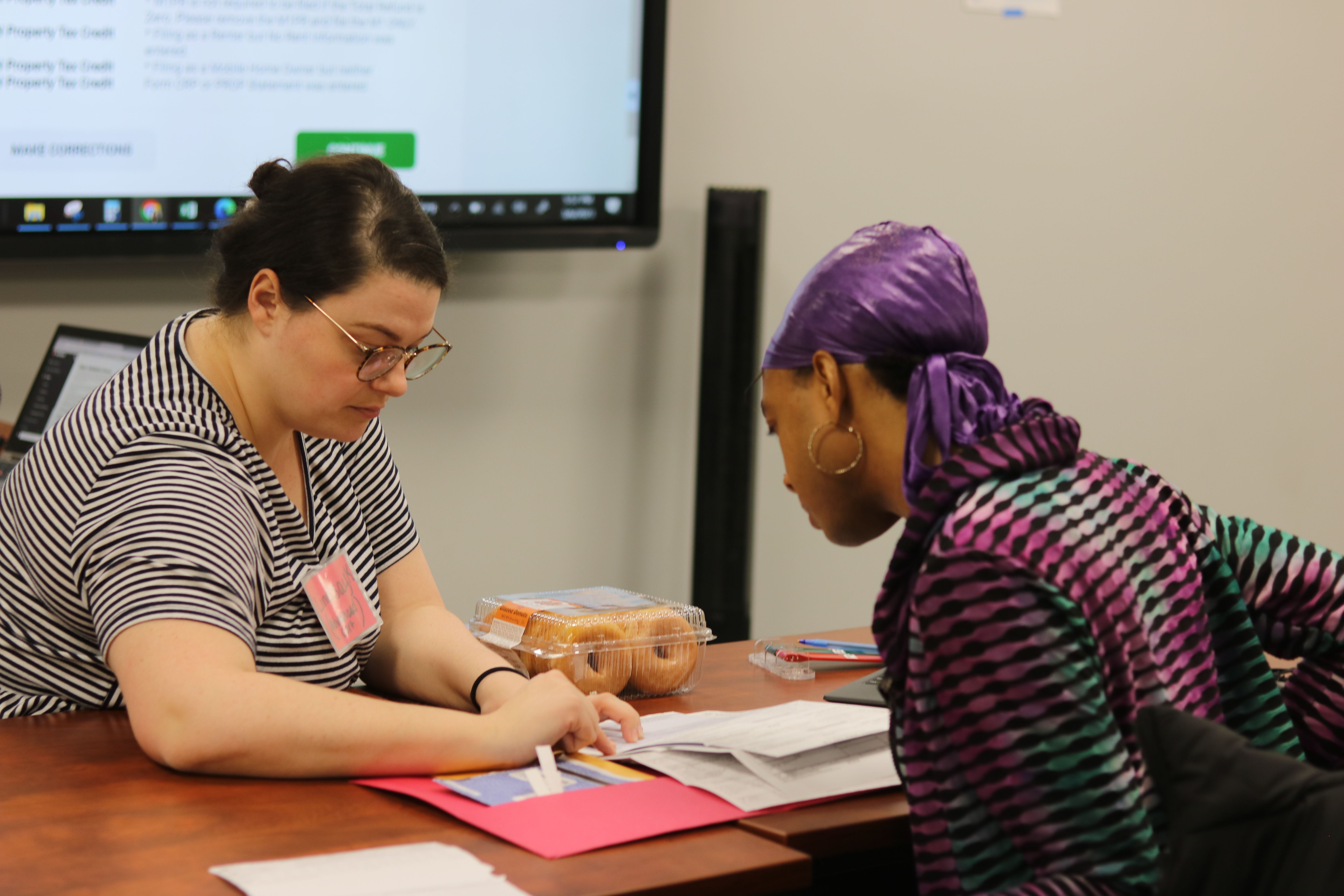

Sign-up for a time to participate in CAPRW’s in-person DIY Tax Prep workshops.