COVID-19 Economic Impact Payments

What is the Economic Impact Payment?

It is a direct payment, money, for U.S. residents or citizens to help with the economic impact of the COVID-19 pandemic.

How much money will people receive?

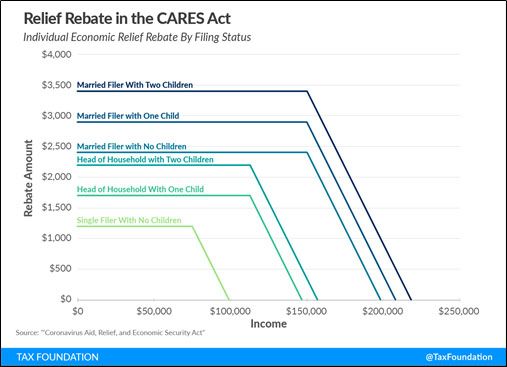

U.S. residents or citizens with an adjusted gross income under $75,000 ($112,500 for head of household and $150,000 married) are eligible for the full $1,200 ($2,400 married) payment. You are also eligible for an additional $500 per child.

For people over the income limit, the payment is gradually reduced and completely phased-out for single filers with incomes greater than $99,000, $146,500 for head of household filers with one child, and $198,000 for joint filers with no children.

How do I get the Economic Income Payment?

The IRS is sending the payment based on the adjusted gross income on your 2019 tax return. If you have not filed your 2019 return, the IRS will use your 2018 tax return. Or if you receive Social Security Administration (SSA) or RailRoad Retirement Benefits (RRB), Supplemental Security Income (SSI), or Veterans Affairs (VA) benefits, the payment will be sent. If you are not usually required to file a tax return, please see the non-filers FAQ below.

If you receive SSA, RRB, SSI or VA, the payment is only for you ($1,200). If you have qualifying dependent children, you will need to file a 2020 tax return next year to register these children as your dependents and receive the $500 per child.

Will I get $500 per child?

If you have a child who is listed as your dependent on your 2018 or 2019 taxes, AND they are under 17 years old and have a Social Security number, then you should be getting $500 per child that meets these conditions. If you were not required to file a tax return in 2018 or 2019, but you have children who qualify as your dependent, are under 17 years old and have a Social Security number, then you can register them using the non-filers tool. Click here for more information.

What if I id not file a tax return in 2019 or 2018, and I do not receive Social Security (SSA or SSI)?

File your tax return as soon as possible. You have until July 15, 2020 to file your return and receive the payment.

You can use My Free Taxes or your preferred tool to file a return. If you miss the July 15, 2020 deadline, you will receive the payment when you file your 2020 tax return. If you are not required to file a tax return, please visit here for information on Non-Filers.

Where will they send the payment?

The IRS will deposit the payment into the bank account listed on your most recent tax return or where your benefits checks are deposited. If you did not use direct deposit, a check or prepaid debit card will be mailed to the address on the return or the address on your benefits checks.

What if my bank account has changed since my last tax return?

The IRS has added a “Get My Payment” form on their website. You can use this form to change or add your direct deposit information. If your payment was sent out before you were able to make the change, you must contact the IRS. Be careful of SCAMS such as emails, social media posts or anyone calling to ask for your bank account information. These are SCAMS. Only use the IRS online portal.

What about adult dependents or if I am claimed as a dependent?

You cannot be the dependent of another taxpayer on their tax return and receive the payment yourself. Plus any dependent over the age of 17 years old does not count for the additional $500 per child payment.

What if my income was higher in 2019 because I had a job, but then I lost my job in 2020 due to the pandemic?

Right now, you will receive the payment based on the adjusted gross income on your 2019 or 2018 tax return. When you file your 2020 tax return, and your income is lower, the IRS will add any additional eligible payment based on your 2020 adjusted gross income.

Is the payment taxable? If I owe money to the IRS or another debt, will this be subtracted from the payment?

The payment is not taxable and it cannot be reduced due to any debts or payments owed to the IRS. The federal government will reduce your payment if you owe back child support. Banks and private debt collectors are still able to withdraw this payment from your bank account if you owe money to them.

For more information about Economic Impact Payments, please visit the IRS website.

Economic Impact Payments for Non-Filers

Who is a Non-Filer?

Non-Filers are people who are not required by the IRS to file a tax return. This applies to people whose 2019 income is below $12,200 or if married $24,400.

How does a Non-Filer get the economic impact payment?

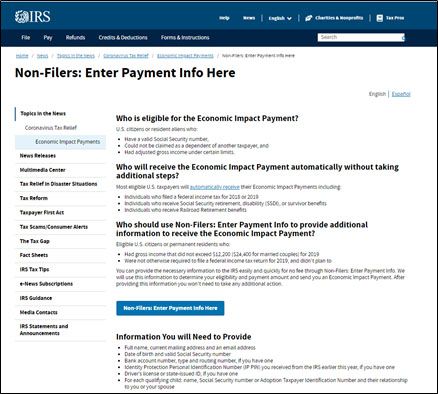

Visit the IRS website and click on the blue button.

This will take you to an online form to register yourself and any dependents. You will enter your name, social security number, date of birth, address, driver’s licenses information, bank account information, and other identifying information. You will also need to enter in the personal information of any dependents you have.

What if I haven't filed my 2019 tax return? Can I just use the Non-Filer form on the IRS website?

No. Unless you are a Non-Filer, do not use the Non-Filer form. If you register as a Non-Filer to receive the payment, when you file your 2019 tax return, it could be rejected. The only option is to file your 2019 tax return as soon as you can. Please visit My Free Taxes to file.

For more information about Economic Impact Payments, please visit the IRS website.